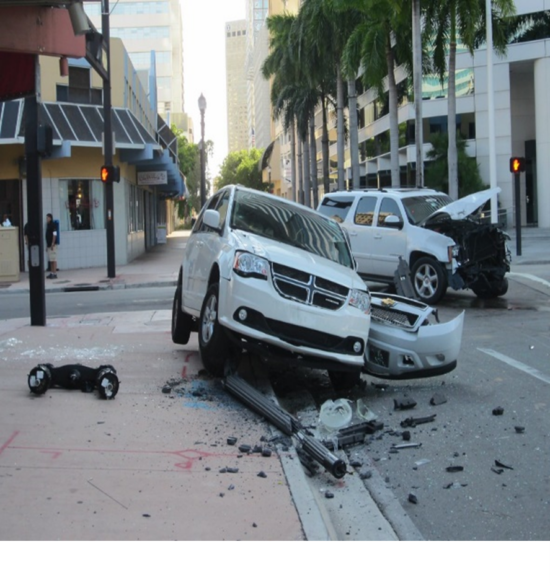

Insurers regularly encounter claims with multiple claimants with serious injuries. Oftentimes, this results in the insurer receiving multiple policy limit demands that exceed the available policy limits. The most common example of this situation is car accidents with multiple injured persons. The total damages in such situations can quickly exceed t

he available policy limits even if the insured has more than the state mandatory minimum of coverage. Multiple policy limit demands place the insurer in a precarious situation. The insurer cannot pay for the damages to one claimant without leaving an insured exposed to the claims by the other claimants, but if it rejects the demand, the insurer may face a bad faith claim.

To address this situation, Missouri enacted R.S.Mo. 507.060, which establishes the rules and deadlines for interpleader actions. The statute allows an insurer facing multiple claims that may expose it to multiple liability to file an interpleader action. However, there are several statutory deadlines and requirements that must be adhered to.

First, the interpleader action must be filed within 90 days after the insurer receives the first offer of settlement or demand for payment. The timeframe determined when the first offer is made. It does not matter whether other potential claimants have sent demands or the insurer is aware of them at the time of the demand. Additionally, the statute does not require the offer or demand to request the policy’s limits. It is vital for insurers to carefully review letters from the claimant’s counsel to determine if there is anything a court may construe as an offer of settlement.

Second, to be effective, the action must name all potential claimants. While not expressly stated in the statute, for an interpleader to be effective, it must include all potential claimants; otherwise, the unnamed claimants may pop up later. The insurer would then face the question of whether to pay the claim despite already tendering its limits. When a claim is first received, the insurer’s investigation must identify all persons potentially injured in an accident or occurrence. Potential claimants can usually be identified by requesting and reviewing police accident reports.

Third, the insurer must deposit all of its applicable coverage limits. This requirement is straightforward. If an insurer elects to pursue an interpleader claim, it must be prepared to tender all of its applicable coverage limits. An insurer cannot contest that the potential damages are less than the applicable limits.

Fourth, the insurer must deposit the funds into the court within thirty days of the court granting interpleader. The insurer will be required to interplead the funds with the court. In Missouri, the insurer must pay the funds into the Circuit Court’s Registry. While typically straightforward, the insurer’s counsel should review the court’s local rules to determine if there are any other requirements. For example, St. Louis County requires the court’s order for the interpleader to be “personally” delivered to the Circuit Clerk if the funds are to be paid into an interest-bearing account. Local Rule 12.6.

If an insurer accomplishes interpleader, it will not be liable to any insured or defendant for any amount above the contractual limits of coverage. However, the interpleader actions will not absolve an insurer of its duty to defend all of its insured in good faith from any claims or lawsuits caused by the same occurrence. Accordingly, an insurer must still defend the underlying claim even if it has interpleaded the funds.